Fintool, Warren Buffett as a Service

Replicating the Oracle of Omaha with AI agents

My Journey with Warren Buffett

As a dedicated Warren Buffett fan, I’ve made it a point to attend the Berkshire Hathaway Annual Meeting every year since I moved to the US. His personal values have greatly influenced my ethics in life, and I'm fascinated by his approach to business.

I've written numerous blog posts over the years on investing, competitive moats, Intelligent CEOs, or whether to buy a house—all inspired by Buffett. Concepts like margin of safety and buying below intrinsic value were key to running and eventually selling my previous startup.

Could an AI Learn to Think Like Buffett?

When I sold my previous company—a legal search engine powered by AI—I invested a portion of my gains into BRK stocks, trusting in Buffett’s methodology. But as someone who has spent over a decade working in AI, a question kept nagging at me: Could an advanced language model do what Warren Buffett does?

Jim Simons from Renaissance Technology made over $100B in profits by using machine learning to analyze vast amounts of quantitative data to identify subtle patterns and anomalies that can be exploited for trading. He relies heavily on quantitative data, but what if we could now do the same for qualitative textual data now that LLMs have reasoning capabilities?

Warren Buffett's letters, biographies, and investment decisions provide a wealth of knowledge about how to find, analyze, and understand companies. There are even textbooks on value investing that detail the step-by-step process.

Deconstructing Buffett's Process

What if we could break down Buffett’s process into individual tasks and use an AI agent to replicate his approach?

At Fintool, we took on that challenge. We deconstructed most of the tasks that Buffett performs to analyze a business—reading SEC filings, understanding earnings, evaluating management decisions—and we built an AI financial analyst to handle these tasks with precision and scale.

Why This Is So Difficult

In some fields, like law, language models are already performing well. Ask an AI to draft an NDA or a Share Purchase Agreement (SPA), and it can quickly generate a document that’s almost ready to go, with minor tweaks. At worst, you might need to provide some context or feed in additional documents, but the model already knows the structure and intent.

Ask ChatGPT to generate a Non-Disclosure Agreement (NDA) for a software company and it will do great. Ask ChatGPT to analyze the owner earnings over the past 5 years of founder-led companies in the S&P 500 and it will fail.

Finance demands both the strengths and exposes the weaknesses of LLMs. Financial professionals require real-time data, but advanced LLMs like GPT-4 have a knowledge cut-off of October 2023. There is zero tolerance for errors—hallucinations simply aren't acceptable when billions of dollars are at stake. Finance involves processing vast numerical data, an area where LLMs often struggle, and requires scanning multiple companies comprehensively, while LLMs can struggle to effectively analyze even a single one. The combination of financial data complexity, the need for speed, and absolute accuracy makes it one of the toughest challenges for AI to tackle.

A Buffett Question: Analyzing Owner Earnings

Let's go back to our question: Compare the owner earnings over the past 5 years of founder-led companies in the S&P 500.

Our LLM Warren Buffett needs to do the following:

Identify founder-led companies within the S&P 500 by reading at least 500 DEF14A Proxy Statements (approximately 100 pages per document).

Understand that Owner Earnings = Net Income + Depreciation and Amortization + Non-Cash Charges - Capital Expenditures (required to maintain the business) - Changes in Working Capital.

Extract financial data from the past 5 years (net income, CapEx, working capital changes) for the 500 companies by reading at least 2,500 annual reports.

Compute the data by comparing year-over-year owner earnings growth or decline, looking at trends such as increasing CapEx, expanding net income, or significant working capital changes.

Write a comprehensive, error-proof report.

This is very hard, every step have to be correct. Institutional investors ask hundreds of questions like that.

Building the Fintool infrastructure

By reading Buffett's shareholder letters, biographies, and value investing textbooks, we broke down Buffett's workflow into specific tasks. Then, we started building our infrastructure piece by piece to replicate these tasks for institutional investors, allowing them to quantitatively and qualitatively analyze a business.

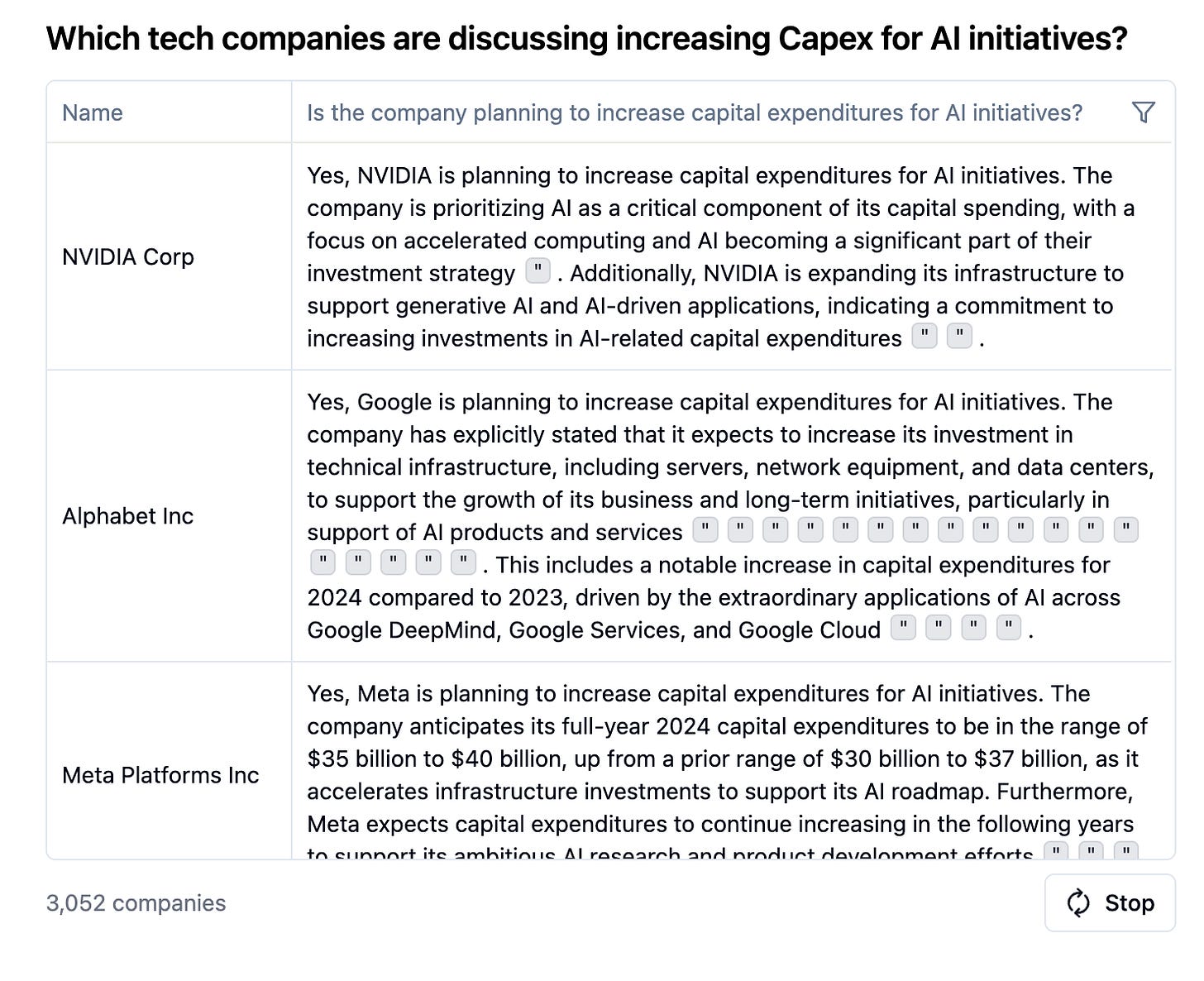

I won't go into the hundreds of tasks we identified, but for instance, we created a "screener API" where you can ask qualitative questions on thousands of companies, like "Which tech companies are discussing increasing Capex for AI initiatives?". With just one data type—SEC filings and earnings calls—we have 70 million chunks, 2 million documents, approximately 500GB of data in Elastic, and around 5TB of data in Databricks for every ten years of data. And that's just one part of the vast amount of data we handle!

We also built another API for our agents that can retrieve any number from any filings, along with its source. Additionally, we have an API that excels at computing numbers efficiently. For that challenge, we have partnered with OpenAI on a research project to use LLMs to extract every data point in SEC filings. Every week, we process 50 billion tokens, equivalent to 468,750 books of 200 pages each, or 12 times the size of Wikipedia. Our sophisticated data pipelines are designed to locate, verify, deduplicate, and compare every data point for accuracy and insight.

We are continuously adding new capabilities to our infrastructure. Our Warren Buffett Agent will use these APIs around the clock to find investment opportunities, analyze them, and respond to customer requests. Although the final product is still in development, we already have a live version in use.

The results are promising. Fintool reaches 97% in FinanceBench, the industry-leading benchmark for financial questions for public equity analysts, far outpacing any other models.

Delivering Practical Value to Customers Today

I refuse to let our website be a placeholder with vague statements like "we are an AI lab building financial agents." Instead, every part of our growing infrastructure is put to practical use and sold to real customers, including major hedge funds like Kennedy Capital and companies like PwC. Their feedback is essential in refining our product, which we believe will be a significant advancement for the industry.

Today, customers use Fintool to ask broad questions like "List consumer staples companies in the S&P 500 that are discussing shrinkage?" or niche questions like "Break down Nvidia CEO compensation and equity package." They can also configure AI agents to scan news filings for critical information such as an executive departure or earnings restatements. This is only the beginning.

Why It Will Be Big

Institutional investors are among the most highly paid knowledge workers in the world. They make millions for their ability to sift through thousands of SEC filings, spot insights, and make calculated decisions on which companies to back. As Greylock noted in their article on vertical AI: “There are several attributes that make financial services well-suited to AI. The market is huge, with $11 trillion in market cap in the U.S. alone, and there's demonstrated demand for AI tools.”

We couldn’t agree more. When you look at the daily responsibilities of these professionals, it’s easy to see where AI fits in. The work requires a mix of mathematical expertise and human judgment. Yet, a significant portion of their workload involves mundane, manual tasks—tasks that Fintool’s AI can automate and optimize.

A Massive and Profitable Industry

The financial research industry is one of the largest and most profitable software verticals in the world, dominated by a handful of key players. Just take a look at the numbers:

Bloomberg: $12B in revenue

S&P Global: $12.5B in revenue, $6.6B EBITDA

FactSet: $1.8B in revenue, $842.5M EBITDA

MSCI: $2.5B in revenue, $1.7B EBITDA

These companies are highly successful because financial professionals are willing to pay a premium for tools that give them an edge. Active investment managers spend more than $30B per year for data and research services.

The Economics of AI in Finance

Adding to that, the unit economics of using AI are vastly better than hiring human analysts. At Fintool, we’re building software that can replace expensive knowledge workers, automating processes that once required teams of analysts. It's crucial knowing the industry is having a talent shortage.

According to the venture firm NFX, “The biggest opportunities will exist where the unit economics of hiring AI are 100x better than hiring a person to do the job.” At Fintool, we fit perfectly into that framework. Here’s why:

Automatable Processes: From screening SEC filings to running detailed financial models, a large part of an investor's workflow can be done by AI.

Cost Savings: In an industry where top analysts are paid millions, the cost savings from using AI are astronomical.

Hiring Challenges: Recruiting top financial analysts is a competitive and costly process, often with long onboarding periods. AI can eliminate these pain points.

Tool Fragmentation: Today’s financial professionals juggle a wide array of tools. Fintool consolidates these into one powerful platform.

Vast Training Data: Fintool leverages proprietary data and vast amounts of public filings to create a unique advantage.

The Future of Financial Intelligence

We’re creating Warren Buffett as a service—a platform that uses advanced language models to find financial opportunities at scale. With the unit economics favoring AI, and the immense potential to revolutionize how institutional investors work, we believe Fintool is positioned to be the next big thing in financial analysis.

If we succeed, we won’t just be building a tool to analyze businesses—we’ll be building the future of how financial professionals make decisions.

Indeed seems like it's a complex challenge to analyze all of this with AI, but also a very intersting one!

✊✊✊